🚥 Greenlight-ing the Future of Family-focused Fintech

Breaking down how Greenlight identified an untapped market, engineered sustainable growth loops, and scaled into a leader in family-focused fintech with over 6 million users.

Would you trust your 13-year-old with a debit card?

Millions of parents across America are now saying “yes” because Greenlight made it easy, safe, and fun. In 2014, Tim Sheehan and his co-founders asked a simple but profound question: why isn’t anyone helping kids learn how to manage money?

Banks’ Blind Spot: The Case for Targeting Kids

For decades, banks ignored younger customers, focusing on adults who generated immediate revenue through loans and credit cards. With customer acquisition costs in finance being notoriously high—often exceeding $300 per customer—targeting kids was seen as unprofitable. Kids didn’t earn, didn’t need complex tools to manage money, and didn’t need credit.

Yet, this assumption overlooked a critical opportunity: kids and teens represented a unique long-term market. Banking relationships often last an average of 17 years, making the early acquisition of younger customers a powerful strategy for securing lifelong loyalty. However, without products tailored to younger users, families were left managing cash allowances, a solution that failed to keep up with the shift toward online banking and digital payments.

Greenlight’s founders recognized the gap for what it was: an opportunity to modernize how families handled money while addressing a deeper issue—the lack of financial literacy in most households.

83% of parents believed teaching kids about money was their responsibility, but only 16% had regular conversations about finances.

Meanwhile, 73% of teens wanted to learn about personal finance but lacked access to tools designed for them.

Greenlight’s solution was simple but powerful: a debit card for kids, managed by parents. But it wasn’t just a card—it was a full financial ecosystem designed to make “money talk” hands-on and fun.

Overcoming Early Hurdles

Parents were naturally hesitant to give kids access to financial tools. To address these concerns, Greenlight focused on features that gave parents full control while making the platform fun and engaging for the kids.

Parental Oversight: Parents could approve or block transactions in real-time, set store-specific spending limits, and automate allowances.

Kid-Friendly Autonomy: Kids received their own debit card, teaching them responsibility and encouraging financial decision-making within boundaries.

Gamified Learning: Features like savings goals, chore-based earnings, and real-time tracking made financial literacy engaging for kids.

In 2017, Greenlight raised $7.5 million in seed funding, led by TTV Capital. This funding allowed the company to scale, refine its platform, and capitalize on the growing demand for financial education tools. Greenlight didn’t just meet the demand—it created it.

Right place, right time

With the rise of digital payments and a noticeable decline in cash usage, especially during and post the pandemic, there’s been a growing interest in kids’ cards. Between 2020 and 2021, Google searches for “kids debit card” surged 227%, driven by the rise of digital payments and a growing interest in financial literacy.

Greenlight positioned itself at the forefront of this trend, branding itself not just as a tool, but as a family-oriented platform that helped parents bond with their kids over money.

The model: Subscription, Not Spending 🔔

Most fintech companies rely on interchange fees—a percentage of every transaction—as their primary revenue source. But Greenlight took a different approach by adopting a subscription-based model. Families pay a recurring monthly fee for access to Greenlight’s features, which unlocked key advantages:

Aligned Incentives: Unlike interchange-driven models, Greenlight didn’t need to encourage kids to spend to generate revenue. Instead, its subscription model allowed the company to focus on teaching good financial habits, aligning its goals with those of parents.

Predictable Revenue: Recurring subscriptions provided a steady revenue stream, enabling Greenlight to reinvest in features like savings, investing, and parental controls.

Building Trust: The subscription model positioned Greenlight as a financial education partner rather than a fintech product benefiting from spending, making it easier to win parents’ trust.

By eliminating reliance on transaction volume, Greenlight was free to double down on its core mission of financial literacy.

On the other side of the world, the India-based app FamPay relied on interchange fees—earning from transactions. Low teen spending volumes amongst teens, especially in geographies like India meant not enough transactions happened to sustain the business. Worse, UPI is free, so there was no reason for teens to use a prepaid card. Without strong monetization, FamPay and its competitors couldn’t scale profitably.

Educational Marketing: Driving Acquisition & Activation 📲

Greenlight had to tackle a core challenge faced by fintech startups: trust. Digital financial services, especially for kids, were still a new and unfamiliar concept for many parents. To overcome this, it focused on an educational marketing strategy that targeted parents through content, and social proof, positioning itself as a thought leader in financial literacy.

Features like savings trackers, goal-setting, and investing explained financial concepts in simple, digestible ways for kids, creating stickiness in the app.

The $7 Million Super Bowl Ad

In 2022, Greenlight made waves by investing $7 million in a 30-second Super Bowl ad starring Modern Family actor Ty Burrell. The ad humorously portrayed Burrell making reckless financial decisions, emphasizing the need for financial literacy.

This move wasn’t just about visibility—it was about credibility. With 113 million viewers tuning in, the campaign introduced Greenlight to millions of families, making it a household name in the kid-focused fintech space.

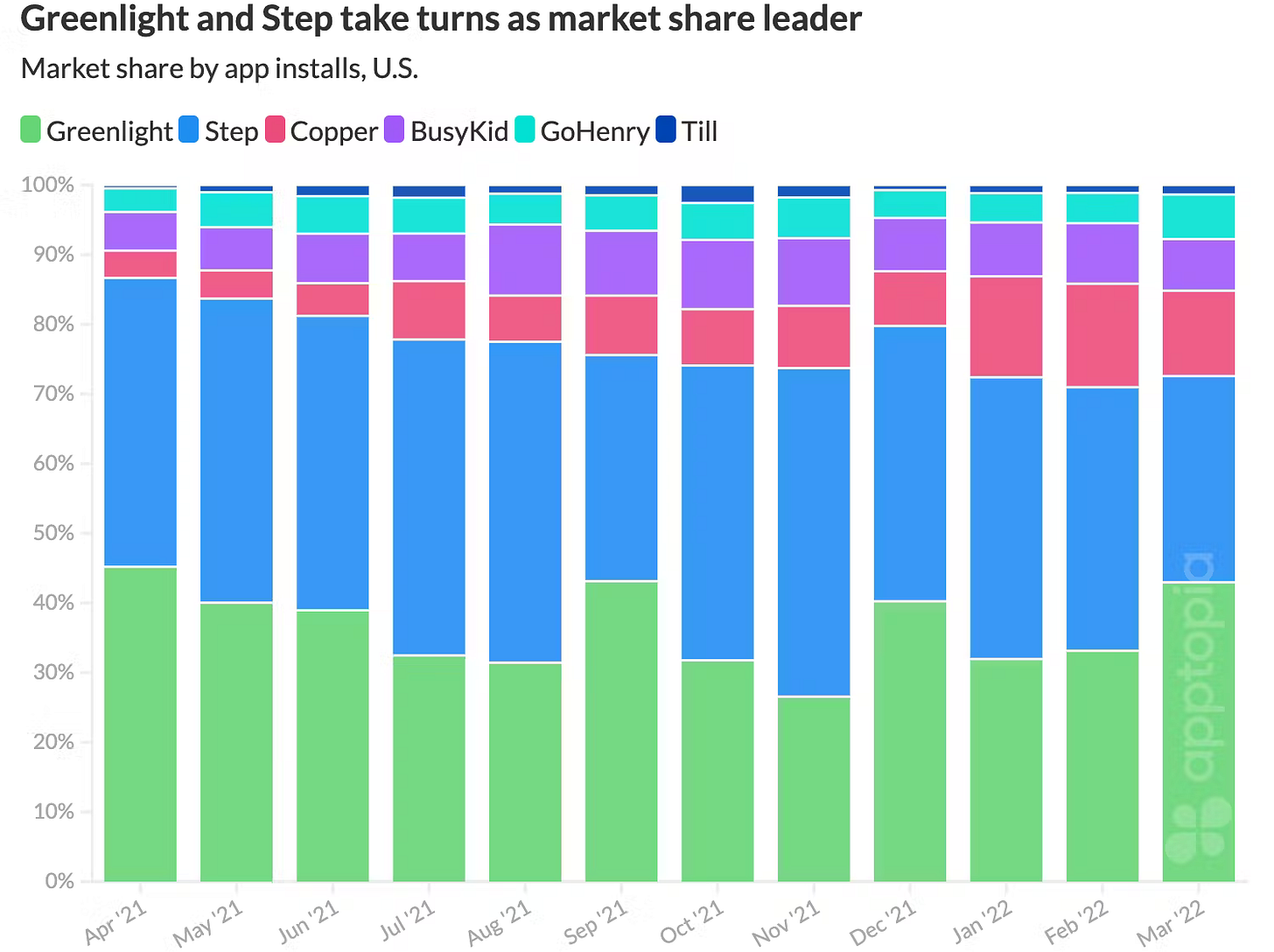

Competitors like Step, which partnered with TikTok star Charli D’Amelio, also leveraged celebrity endorsements, but Greenlight differentiated itself by focusing on parents as decision-makers through humour and reliability.

Beyond the Card: Growing Through Saving, Investing, and Gamification 💰

Greenlight didn’t stop at giving kids a debit card—it built an ecosystem to create engagement loops, double down on retention and worth—of-mouth, and extend lifetime value (LTV).

Savings & Investing as a Growth Engine

Launched in 2021, the feature allowed kids to:

Invest in Stocks and ETFs: Greenlight made complex financial concepts simple, approachable, and exciting by helping kids invest in brands they loved (think Disney, Netflix, or Tesla) with parental approval. Families stayed longer to see their investments progress.

👍 P.S. Stories of kids investing their first $10 in Tesla or reaching savings milestones were a hit on parenting forums and social media. :)

Stock Investing for Teens: Teens invested in fractional shares of companies like Apple or Tesla, learning wealth-building while collaborating with parents.

Learn Through Action: The platform included simple explanations of key investing concepts like risk, diversification, and returns, empowering kids to understand the why behind their investment choices.

Parent-Child Collaboration: Parents retained control over investments, approving trades and guiding their kids’ financial decisions.

Engagement Through Gamification

Greenlight understood that to make financial literacy stick, it had to be fun. Once families joined, the tool kept them engaged through interactive features that turned money management into a game:

Savings Goals: Kids could set personal goals (e.g., saving for a bike), while parents “boosted” milestones.

Chore Management: Parents assigned chores and automated allowances, turning money management into a family activity.

Referrals for a Dual-Loop for Growth 🔂

At the heart of Greenlight’s growth was its ability to engage two distinct but interconnected user groups: parents and kids. This dual-engagement strategy created a cost-efficient customer referral loop:

Kids as Advocates: Kids loved having their “own” debit cards, which gave them a sense of independence and responsibility. This naturally led to peer-to-peer virality, with kids sharing their Greenlight experience with friends and classmates.

Parents as Advocates: Parents, proud of teaching their children money management and incentivized through rewards, shared Greenlight with friends, relatives, and other families—both in person and on social media. Parenting communities, which thrive on sharing advice, became a natural channel for referrals.

Referred families tended to be more loyal, reducing churn and ensuring high engagement.

Retention Through Lifecycle Engagement 👨👩👧

One of Greenlight’s smartest moves was creating a product that evolved with families. Instead of being a one-off app for kids, Greenlight became a financial ecosystem that addressed different needs as children grew:

Younger Kids: Features like savings goals, chore-based allowances, and budgeting tools hooked younger children and their parents.

Teens: As kids grew older, Greenlight introduced them to investing, stock trading, and more advanced financial concepts, ensuring the product remained relevant.

Parents: With the Family Cash Card and household-wide tools, Greenlight positioned itself as a platform for the entire family, not just the kids.

By aligning features with different stages of a family’s financial journey, Greenlight extended its stickiness and reduced churn. Families didn’t outgrow the platform—instead, they deepened their engagement over time.

Partnerships with Financial Institutions 🤝

Greenlight’s ability to solve a common-sense problem—teaching kids about digital banking—didn’t just appeal to families. It also created opportunities for financial institutions to engage younger audiences. Starting in 2023, Greenlight began striking partnerships with banks and credit unions, giving them a turnkey way to offer financial literacy tools to families.

This strategy provided mutual benefits:

For Banks: Greenlight helped banks acquire younger customers and build loyalty with families—a demographic that traditional financial institutions struggled to reach.

For Greenlight: Embedded partnerships allowed Greenlight to generate more revenue streams without relying solely on the direct-to-consumer acquisition, significantly broadening its reach.

Its partnership with the U.S. Bank marked a turning point. U.S. Bank became the first to embed Greenlight’s tools—like kids’ debit accounts and parental controls—directly into its mobile banking app. This embedded model allowed Greenlight to scale its impact while providing banks with a turnkey solution for engaging younger customers.

Today, Greenlight is working with about 50 financial institutions, including major players like JPMorgan Chase, United Community Bank, and PSECU.

Why Teen Banking Thrives in the U.S. but Faces Challenges in Developing Economies like India 💭

On paper, teen banking apps seem like a universal win. Yet, while apps like Greenlight, and Step scaled rapidly in the U.S., similar apps struggle to sustain themselves in India. The difference comes down to cultural attitudes, financial infrastructure, and business viability.

Banking for Minors: A Different Reality in India

Both the U.S. and India allow minors to have bank accounts with parental oversight. But while American teens actively manage joint accounts and custodial savings, Indian minor accounts are mostly parent-controlled savings vehicles rather than everyday spending tools.

Even though 75% of Indian families discuss finances together, financial independence comes much later. In India, money is still a family-managed resource, not an individual one. Instead of giving kids independent spending power, parents handle purchases directly - tuition, shopping, and entertainment. Teen spending behaviour in India simply isn’t high enough, making the idea of a standalone teen banking product less compelling.

UPI Killed the Need for Teen Debit Cards in India

The biggest structural difference between these markets is how people pay.

U.S., UK: A card-based economy, where teens need debit cards to shop online or pay in stores. Greenlight’s core offering- a debit card with parental controls and financial literacy tools—fit naturally.

India: The rise of UPI made teen debit cards irrelevant. Parents don’t need a separate financial product for their kids—they just transfer money via UPI. Instant, free, and universally accepted, UPI replaced both cash and card-based transactions, leaving FamPay, Junio and more struggling for relevance.

Greenlight didn’t just build a product—it fit into existing behaviours while its Indian counterparts tried to change them. UPI and family-managed bank accounts continue to dominate how Indian teens handle money.

The Bigger Picture 🛣️

Greenlight’s story isn’t just about its sleek app or colourful debit cards. It’s about how the company has mastered trust, retention, and scalable growth in the competitive fintech space, all while establishing itself as a lifelong financial partner for families.

As this fintech ecosystem becomes more competitive, with players like Step and Revolut Junior expanding their offerings, Greenlight is not standing still. The company is deepening its engagement and lifecycle relevance with features that align with the evolving needs of families.

From helping kids learn the basics of saving and budgeting to guiding teens into investing, Greenlight is now expanding its ecosystem to meet the needs of older teens and young adults with:

Credit-Building Tools: Providing secured credit cards or credit-building features to help teens establish responsible credit habits under parental guidance.

College Savings Solutions: Introducing tools that simplify planning and saving for higher education, addressing a key concern for families with teens.

Advanced Financial Planning: Expanding into budgeting and wealth-building tools tailored for young adults as they step into financial independence.

By building a comprehensive financial ecosystem (just as Apple cultivated an ecosystem that seamlessly connects devices and services), Greenlight ensures that families remain engaged and supported throughout their entire financial lifecycle. It positions itself not just as a product but as a trusted partner that grows alongside its users.

Thanks for reading! 😄

One Step Ahead is a publication by Plotline. With this series, we plan to give you a behind-the-scenes breakdown of the product and growth strategies that have propelled consumer apps to where they are today.