The Common Thread Behind INDmoney and Goibibo’s Explosive Viral Growth

Diving in headfirst to uncover how two companies in very different industries both exploited viral growth strategies.

One is an online travel aggregator, and the other is a personal finance and investment platform. They have a lot in common though. For one, they were both started by Ashish Kashyap. What's even more interesting, is that they both achieved tremendous scale propelled by assertive viral loops. Let’s dig in.

Goibibo: Catching the travel bug ✈️

After spending 18 months at Google as Country Head for India, Ashish decided to make a foray into the startup landscape.

Ashish founded Ibibo in 2007 as an incubator in Gurgaon with financial support from South African internet giant Naspers. Several ventures would emerge from it, including an online gaming platform and a payment solutions provider. We’re most interested however, in the online travel aggregator born out of this incubator in 2009 - Goibibo.com.

The online travel space was becoming massively competitive with the rise of MakeMyTrip, Yatra and a plethora of such travel aggregators, and at the time, Goibibo was just an 8-member team.

How do you differentiate in such a competitive space?

Ashish saw the opportunity provided by a specific vertical - hotels - and decided to solve for hotels exceptionally well, making it their prime focus.

Why focus on hotels, though?

Higher margins compared to airlines 🤑. High supplier fragmentation in the hotel industry gave any intermediary more bargaining power. Compare this to airlines, where the large airlines have obliterated the economics of online ticketing marketplaces.

Scope of gamification in hotel supplier base to build a moat. Again, due to high fragmentation, it becomes easier to onboard hotels and make them play by your rules. We'll shortly get to how Goibibo played this to their advantage while acquiring supply.

Goibibo also decided to pursue a different customer acquisition strategy.

"When you're the 50th person in the space, you can't compete on playbooks built by your competitors." - Ashish Kashyap.

While other players focused on heavy advertising, Ashish decided that his company would grow on the back of a solid product foundation.

Here's how they used the strength of social networks and gamification to drive millions of downloads:

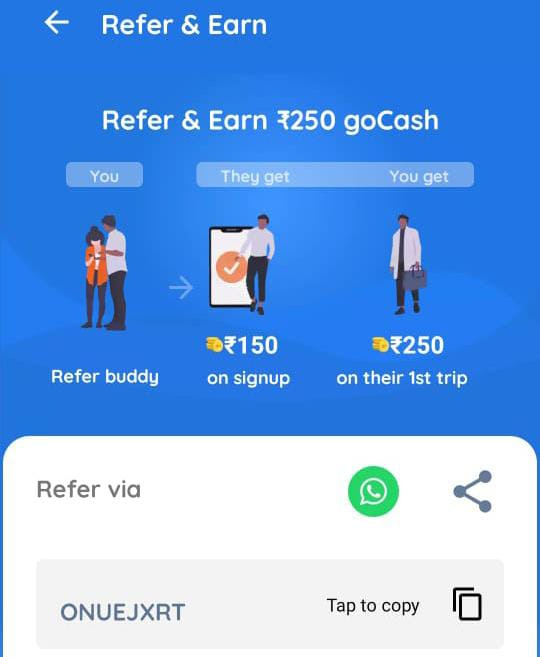

Referral program + Wallet GoCash 💵. Nearly every B2C app implements a referral program, but only a handful manage to make it their top acquisition channel. Here's what worked for Goibibo:

Reduce friction in sending invites. GoIbibo would sync with users' contact books to ensure the cognitive load to send out invites is almost zero.

Ensure rewards drive further usage. Ashish understood well how "platform currency" works. On referring others, you were rewarded with GoCash, which could be spent on your next booking.

Strengthened network effects with GoContacts📱. Travel is generally a solo or a small group affair. The Goibibo team wanted to leverage the power of a social network. GoContacts managed to do this by syncing with your phone book. Whenever your friends travelled using Goibibo, you would get rewarded with GoCash that could be spent on your next travel. It was so successful that within ten days of launch, 3.4 mn users had come aboard the platform.

Gamification on the supplier side 🎮. Goibibo developed an application for hotel owners called Ingoibibo. It allowed owners to manage inventory, receive yield and pricing data, and see their performance compared to competitors. Providing hotel owners with real-time information about other hotels in their vicinity drove a positive paranoia amongst the hotels.

This led Goibibo to quickly become the most prominent mobile traveller app.

Then in October 2016, Goibibo merged with MakeMyTrip. The combined entity was worth $1.8B, with Goibibo valued at ~$720Mn. This was the biggest merger in India's online travel space.

Ashish left the combined entity almost a year later and, shortly after, founded INDmoney.

INDmoney: India's Super Money App 💰

Once more, feeling the need to scratch a personal itch, this time around an individual's financial life and management, Ashish started INDmoney in 2019. According to him, the problems faced by consumers regarding money management were:

Consumers who want to improve their financial life can't manage everything in one place. It was a very fragmented experience.

Consumers are lazy (tell me about it 😭)

The traditional finance ecosystem is non-transparent

He set out to give users a 360degree view of their assets and liabilities. This was different from other PFM apps at the time that focused solely on the user's cashflows. Ashish's choice was built on one fundamental insight - people are keener to see their net worth rather than cashflows.

Adding an intelligent AI layer that helped people plan their goals or make decisions - buying a home, retiring early, paying off a car loan early - would be the cherry on the cake 🎂.

Today INDmoney boasts >5M+ users and $2B of GMV on the platform in the last year. How did they get here?

Using US stocks as a hook 🪝to drive adoption

Typically, fintech platforms have used payments as a hook to acquire new customers. Given the fierce competition in the payments space, Ashish chose to focus on US stocks and net worth tracking.

Indians wanted to invest in Google and FB; however, all traditional methods were expensive and lined with hurdles.

INDmoney made opening a US stock account frictionless and cheap.

Instant gratification to the consumer in minutes 🕚

For X effort put in by consumers, INDmoney gave them 10X value - VERY QUICKLY.

As soon as a person permitted INDmoney to view their email, they could pull credit card payments and credit score, track your mutual funds, and show you your net worth (assets - liabilities).

The emphasis here is on showing that value instantly, as soon as the user has signed up.

The net worth is another excellent hook to keep people coming back to see how it has changed over time.

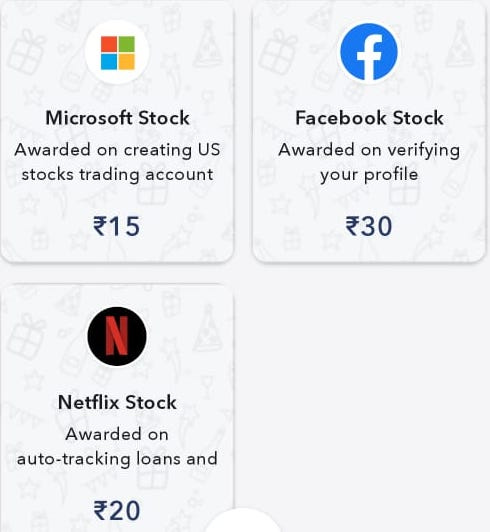

Using platform currency of stocks in their referral program

INDmoney had solid word-of-mouth, and Ashish's experience at Goibibo made him quite confident that a referral program could work here as well.

INDmoney gave rewards in stock options of blue-chip companies like Netflix and Apple whenever a person completed an excellent financial action or referred their friends. This platform currency of stock options got the user started on their investment journey, made them "invested" in the platform itself, and kept them coming back.

"More important than the price itself is the journey leading up to the price" - Team Plotline 🤓

INDmoney has already shown you value by tracking your net worth, automatically pulling in credit card debts, telling you your credit score and much more. When you decide to set up your Goals, it takes you through another journey asking for inputs such as what goals you want to save for, how much you'll save every month, etc.

After clicking on the final CTA to get AI-based recommendations, you face a paywall. You're slightly disappointed, but the motivation from the value received earlier + the time you've spent setting up your goal, nudges you to pay for the Premium plan, which is priced at only INR 99/- per month.

INDmoney raised an $86M Series D funding round in Mar '22, taking its total funding to $143M so far and valuation to north of $650M.

They recently enabled an insurance offering and have grand plans going ahead. Their eventual goal - become the ONE APP for ALL YOUR MONEY. 🤯

We are huge fans of INDmoney's phenomenal growth. We'll be rooting from the sidelines for this rocketship. 🚀